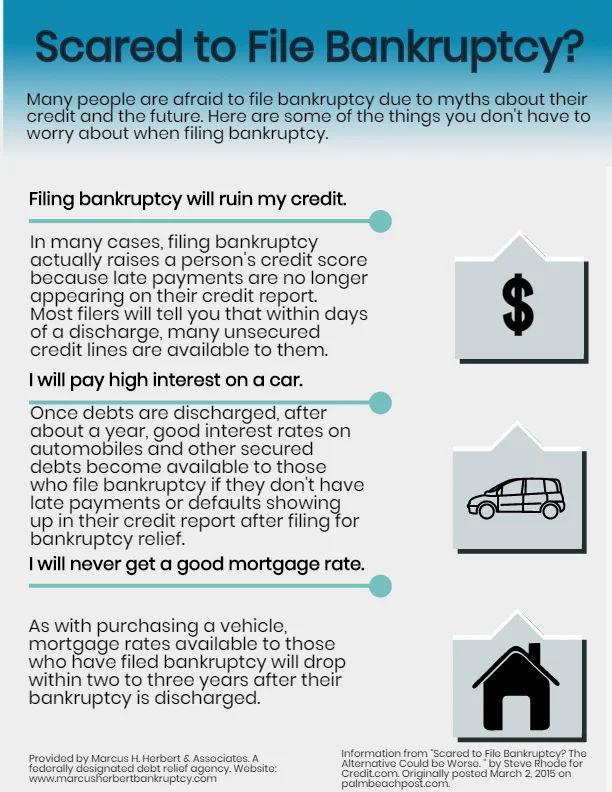

Scared to File for Bankruptcy?

Many people are afraid to file bankruptcy due to myths about their credit in the future. Here are some of the things you don't have to worry about when filing bankruptcy.

Filing bankruptcy will ruin my credit:

In many cases, filing bankruptcy actually raises a person's credit score because late and non-payments are no longer appearing on their credit report. Most filers will tell yu that within a few days of their discharge, many unsecured credit lines are available to them.

I will pay high interest on a car:

Once debts are discharged, after about a year, good interest rates on automobiles and other secured debts become available to those who file bankruptcy, if they don't have late payments or defaults showing up in their credit report after filing for bankruptcy relief.

I will never get a good mortgage rate:

As with purchasing a vehicle, mortgage rates available to those who have filed bankruptcy will drop within two to three years after their bankruptcy is discharged.

Provided by Marcus H. Herbert & Associates, a federally designated debt relief agency. Information from “Scared to File Bankruptcy? The Alternative Could be Worse.” by Steve Rhode for Credit.com, orignially posted March 2, 2015 on palmbeachpost.com.